Atm Fee For Cash App

There is a maximum ATM cash back withdraw limit of 400 day total from the Branch card. Ask a friend with a GCash account to help you out using SendReceive Money and handing the cash to you.

Where Can I Use My Cash App Card For Free Never Pay A Fee Almvest

Limits on surcharge-free 0 ATM transactions may apply.

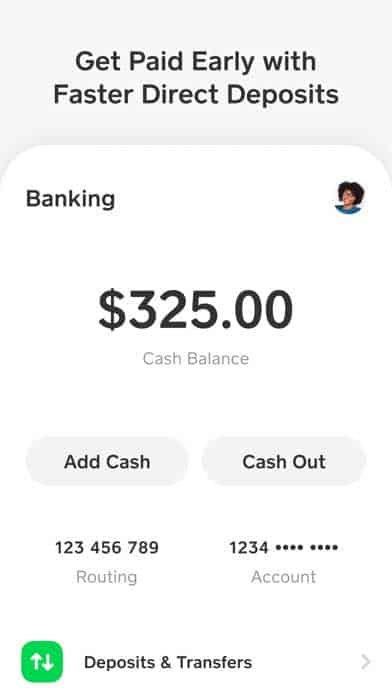

Atm fee for cash app. Given that Cash App is still a peer-to-peer platform Cash App users can only withdraw small amounts of money even every month. ATM Fees on Cash Card Cash Cards work at any ATM with just a 2 fee charged by Cash App. To view your ATM cash back limits-Open your Branch app and click the settings gear icon in the upper right hand corner of your Wallet page-Tap on.

Cash App Cash Card Free ATMs____New Project. This is the same regardless of how much youre withdrawing and it comes out of your Cash App balance. How To Use Cash App Card At ATM Tutorial____New Project.

You can get all these fees reimbursed by. Cash-out via GCash Mastercard in ATMs. And now Allpoint deposit-enabled ATMs help you load cash to participating accounts.

Most ATMs will charge an additional fee for using a card that belongs to a different bank. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to. What Are Cash App Cash Card ATM Fees__Try Cash App using my code and well each get 5.

Here you will find the answer to all of your questionsbe competent be more skilful than others. Fees apply for approved money in minutes transactions funded to your card or account. As a standard youll be paying a 2 fee per transaction at an ATM with your Cash App card.

There is a maximum ATM cash back withdraw limit of 300000 month total from the Branch card. This fee is assessed for each withdrawal transfer or balance inquiry performed at a non-Bank of America ATM in a foreign country. Those fees are limited to 7 each as well.

ATM Fees 2 Per Transaction While Cash App will reimburse fees youre charged at ATMs theyll only do it for three charges in a 31 day period. There is no charge for over-the-counter OTC bank teller cash withdrawals at Visa member banks but fees for ATM transactions at these locations may apply. If you have direct deposit the Cash App does reimburse the ATM fees but if you dont they make 2 per transaction.

The Cash App charges a 2 fee for the service. Please refer to your Card Fee Schedule. Cash into your ShopeePay and do a ShopeePay transfer to a supported bank you have an ATM account with.

This is the same regardless of how much youre withdrawing and it comes out of your Cash App balance. So if youre charged two 6 fees and one for 10 youll still have to pay 3 in ATM fees for that month. Viewing changing your ATM cash back limit preferences.

Allpoint gives you freedom to get your cash how you want without ATM surcharge fees at over 55000 conveniently-located ATMs. Cash cards work at any atm with just a 2 fee charged by cash app. Cash Support ATM Fees on Cash Card Cash Cards work at any ATM with just a 2 fee charged by Cash App.

Once this feature was available to every Cash App user Cash App introduced withdrawal ATM fees. Places to load Cash App Card. Chimes network has more than 38000 fee-free MoneyPass ATMs.

This is in addition to any fees the bank charges for themselves. As a consumer you gain access to the Allpoint Network through your financial services provider. Green Dot Network cash reload fees and limits apply.

Please refer to your Card Fee Schedule. It charges the sender a 3 fee to send a payment using a credit card and 15 for an instant deposit to a bank account. Most ATMs will charge an additional fee for using a card that belongs to a different bank.

Transfer to GSave then withdraw using CIMB ATM 2. Users can use their Cash App debit card at any ATM. Cash App users who use their Cash App Cash Card to withdraw at any given ATM are charged a fee of 2.

8 rows Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. The non-Bank of America ATM usage fee is 5. Heres when your Cash App will charge you a fee.

Cash cards work at any atm with just a 2 fee charged by cash app. This is the same regardless of how much youre withdrawing and it comes out of your Cash App balance. In addition the ATM operator may charge an access fee for cash withdrawals.

Besides does cash App charge ATM fees. Despite offering the service for free when it first started Cash App does charge a 2 fee per every ATM withdrawal transaction. Php 10 Php 18 per withdrawal depending on ATM 1.

The amount of money you can withdraw at an ATM is also limited. ATM Fees on Cash Card Cash Cards work at any ATM with just a 2 fee charged by Cash App.

Where Can I Use My Cash App Card For Free Never Pay A Fee Almvest

Understand The America Rescue Plan Act Of 2021 Including The Third Round Of Economic Impact Payments Also Known As Stimulus Checks In 2021 Cash Cash Card Send Money

Cash App Carding Method 2021 100 Working Guide Step By Step

What Atm Can You Use For Cash App What Atm Is Free For Cash App

What Is Cash App Pros Cons Features Nextadvisor With Time

Easy Steps To Buy Sell Bitcoin On Cash App In 2021 Buy Bitcoin Cash Program Bitcoin

/cdn.vox-cdn.com/uploads/chorus_image/image/66638382/Cash_App___Dollar___Full.0.jpg)

Square S Cash App Details How To Use Its Direct Deposit Feature To Access Stimulus Funds The Verge

How To Use Your Cash Card After You Sign Up For And Activate It In The Cash App Cash Card Visa Debit Card Mobile Payments

Cash App For Business Account Use Fees Limits Explained

Pin By Rebecca Overshon On White Magic Beccas Magic Amazon Gift Card Free App Being A Landlord

Cash App Free Money How To Get Money On Cash App Youtube How To Get Money Free Money Hack Free Money

Cash App Square Cash App Refund Customer Service Number In 2021 How To Get Money Cash Online Cash

Post a Comment for "Atm Fee For Cash App"